Page 2 of 4

Posted: Mon Nov 26, 2007 3:22 pm

by ElfDude

awip2062 wrote:Is it any wonder the people of this nation are so in debt? Tricks everywhere coupled with advertising that makes us think we need it all.

You hit the nail on the head.

All around that dull grey world

Of ideology

People storm the marketplace

And buy up fantasy

The counter revolution

At the counter of a store

People buy the things they want

And borrow for a little more

Not a day goes buy where I don't think about how thankful I am that my mortgage is my one and only debt.

Posted: Tue Nov 27, 2007 8:15 am

by Big Blue Owl

Something I saw:

Elf's post about being glad he only has a mortgage debt.

Me too! I've paid everything else off and concentrating on whittling down the mortgage over the next 25 years.

Fingers crossed for luck.

Posted: Tue Nov 27, 2007 8:18 am

by ElfDude

Big Blue Owl wrote:

Fingers crossed for luck.

Yeah, best of luck with that!

Barring any catastrophe, this house should be paid off in less than nine years. My savings stink. But at least there won't be a mortgage hagning over my head.

Posted: Tue Nov 27, 2007 8:25 am

by CygnusX1

pay a little MORE on it every month, and you pay it off even earlier...

AND save money on finance charges to boot...it's all good.

7 years left on mine. Rock on.

Posted: Tue Nov 27, 2007 8:27 am

by Walkinghairball

28 years left on mine.....................I'm in debt up to my eyeballs.

It's not so bad.

Posted: Tue Nov 27, 2007 8:53 am

by CygnusX1

I was too Brudda. But my above post is how I got NOT.

No question ya gotta scrimp. There was much stuff I wanted (and

wanted to do) that had to be put on hold.

But I survived, my marriage survived, and life goes on.

Posted: Tue Nov 27, 2007 3:01 pm

by awip2062

Anyone ever listen to or read this guy's stuff? Dave Ramsey?

http://www.daveramsey.com/

He's got a great set of steps (not all developed by him, but he's compiled them and teaches people how to walk through them) to help people get out of debt.

The first three steps are:

1) Save up $1000 in an emergency fund so you can quit using your credit cards when something unexpected (which always seems to pop up) pops up.

2) Pay off all debt but for the house. He uses something he calls the Debt Snowball to do that. This is how he describes the Debt Snowball.

Debt Snowball Plan

The principle is to stop everything except minimum payments and focus on one thing at a time. Otherwise, nothing gets accomplished because all your effort is diluted.

First accumulate $1,000 cash as an emergency fund. Then begin intensely getting rid of all debt (except the house) using my debt snowball plan. List your debts in order with the smallest payoff or balance first. Do not be concerned with interest rates or terms unless two debts have similar payoffs, then list the higher interest rate debt first. Paying the little debts off first gives you quick feedback, and you are more likely to stay with the plan.

Build Momentum

Redo this each time you pay off a debt, so you can see how close you are getting to freedom. Keep the old papers to wallpaper the bathroom in your new debt-free house. The ?New Payment? is found by adding all the payments on the debts listed above that item to the payment you are working on, so you have compounding payments which will get you out of debt very quickly.

?Payments Remaining? is the number of payments remaining when you get down the snowball to that item. ?Cumulative Payments? is the total payments needed, including the snowball, to pay off that item. In other words, this is your running total for ?Payments Remaining.?

Debt Free!

You attack the smallest debt first, still maintaining minimum payments on everything else. Do what is necessary to focus your attention. Keep stepping up to the next larger bill.

3) Put 3-6 months of expenses into savings so that if something happens to your job you can live while you find a job you want rather than just jumping at the next thing you find or if you can't work for whatever reason you don't lose your home.

He has more steps after this to help you build your funds up for college savings for the kids, retirement, et cetera.

Posted: Tue Nov 27, 2007 3:24 pm

by ElfDude

awip2062 wrote:Anyone ever listen to or read this guy's stuff? Dave Ramsey?

Yup. I know who that is. And he makes a lot of sense!

Posted: Fri Nov 30, 2007 9:52 am

by Walkinghairball

I forgot to tell you all 'bout this one.

I saw a dude driving his convertable Miata AGAIN this morning on my way to work......................

.........it's 19 degrees this morning!!!!!!

Twice this week he did this. I have no idea who it is, but talk about a real numb nuts.

Posted: Fri Nov 30, 2007 10:45 am

by CygnusX1

Walkinghairball wrote:I forgot to tell you all 'bout this one.

I saw a dude driving his convertable Miata AGAIN this morning on my way to work......................

.........it's 19 degrees this morning!!!!!!

Twice this week he did this. I have no idea who it is, but talk about a real numb nuts.

he was born with NO NERVE ENDINGS! hahaha

Gah! Reminds me of a guy I worked with....he wore t-shirts outside - no matter HOW cold it was...knucklehead...

Posted: Thu Mar 13, 2008 8:28 am

by Big Blue Owl

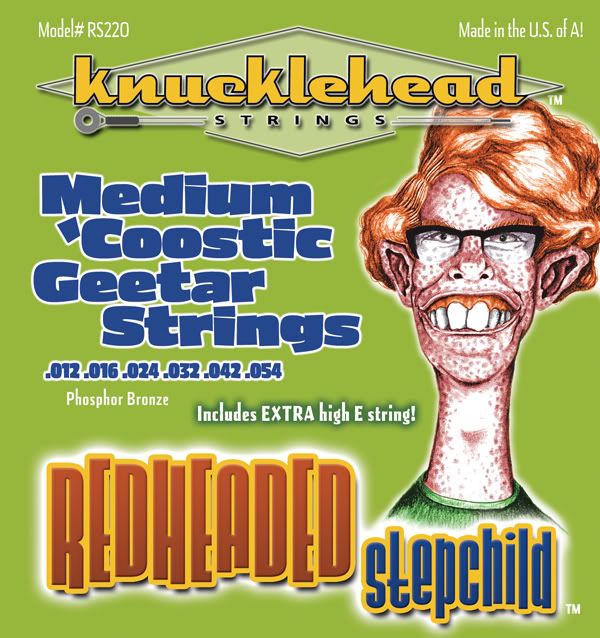

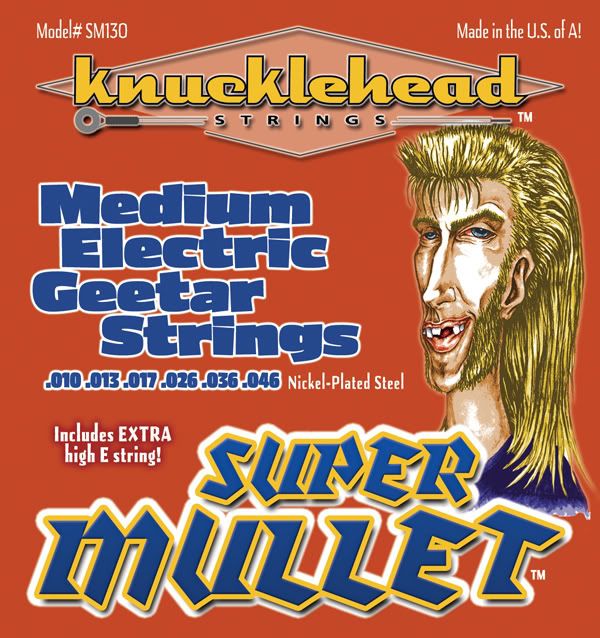

After reading Cyg's post I saw these;

Posted: Mon Mar 17, 2008 12:50 pm

by awip2062

This music school the kids used to go to sold those! I thought they were hilarious!

Posted: Mon Mar 17, 2008 1:56 pm

by Walkinghairball

In total there are 18 users online :: 6 Registered, 0 Hidden and 12 Guests [ Administrator ] [ Moderator ]

Most users ever online was 121 on Sun Jul 01, 2007 5:31 pm

Registered Users: Big Blue Owl, ElfDude, Sir Myghin, Soup4Rush, Traveler of Willowdale, Walkinghairball

Posted: Wed Apr 02, 2008 2:35 pm

by YYZ30

Something I saw today:

http://en.wikipedia.org/wiki/Sin_Tetas_ ... _series%29

American soap operas suck!

(hint: read the translated title)

Posted: Thu Apr 03, 2008 5:02 am

by CygnusX1

***Calls Comcast and begs for Telemundo Channel***