Economics, Humanity and Oil

Posted: Thu Aug 18, 2005 10:10 am

I haven't been on in awhile as I have alot on my plate, unforchantly it's sometimes hard to digest. I just thought I'd share some opinions that may open your eyes a bit wider.

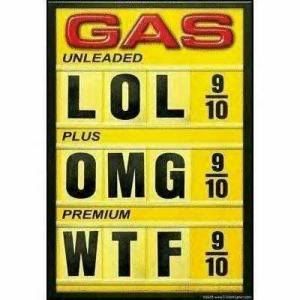

What's problematic is not so much running completely out of oil but what happens when the global peak production of oil is reached, after which point oil production can no longer keep up with demand for it.

Supply drops below demand and prices skyrocket. It's at that point that the economic crisis of oil as a finite resource will begin to hit, not when the last extractable drop of oil is taken from the ground. This is likely to be pretty drastic: Obviously gas prices will skyrocket, but demand is pretty inflexible. We all have to get to work. Our food typically takes more petrochemical calories to produce than food calories yielded. Our food has to be transported to us on trucks that are owned by small to large businesses that will increasingly not be able to afford diesel prices and will have to lay off workers. A lot of businesses will be laying off workers, leaving people with no means to buy the increasingly expensive commodities on which they depend. This could be politically explosive, if not outright dangerous.

An interesting way to conceptualize this is the "Hubbert's Curve." King Hubbert was a geophysicist who, in 1949, predicted the trajectory of oil extraction in the United States. He figured that the rate of extraction would increase in response to demand, itself fueled

(sorry) by the increasing success in finding oil. This increase would follow a logistic curve, with almost exponential increase at first, followed by a period of increase at slower and slower rates as the easily extractable reserves are tapped out and more expensive technology has to be applied. At some point, extraction would peak and then extraction would drop in a nearly mirror image pattern as the costs of extracting the scarcer and scarcer resource begin to increase exponentially and its success begins to decrease exponentially. The result, plotted through time, looks kind of like the familiar bell curve from the statistical normal probability distribution. In 1949, using this logistic curve, Hubbert predicted that U.S. oil fields would peak around 1960 or so, accurately, it turned out.

Using the same methodology, a number of people have been working on the global Hubbert's Peak. I've heard estimates ranging from 2005 to 2020, so your guesstimate is right smack in the middle of the range.

A very nicely written summary of the situation is given by David Goodstein of Caltech in a popular book entitled, "Out of Gas: The End of the Age of Oil."

Here's a link to the Amazon listing:

http://www.amazon.com/exec/obidos/tg/de ... ce&s=books

Wikipedia has a nice summary, including a few critics of the Hubbert's model:

http://en.wikipedia.org/wiki/Hubbert_peak

What's problematic is not so much running completely out of oil but what happens when the global peak production of oil is reached, after which point oil production can no longer keep up with demand for it.

Supply drops below demand and prices skyrocket. It's at that point that the economic crisis of oil as a finite resource will begin to hit, not when the last extractable drop of oil is taken from the ground. This is likely to be pretty drastic: Obviously gas prices will skyrocket, but demand is pretty inflexible. We all have to get to work. Our food typically takes more petrochemical calories to produce than food calories yielded. Our food has to be transported to us on trucks that are owned by small to large businesses that will increasingly not be able to afford diesel prices and will have to lay off workers. A lot of businesses will be laying off workers, leaving people with no means to buy the increasingly expensive commodities on which they depend. This could be politically explosive, if not outright dangerous.

An interesting way to conceptualize this is the "Hubbert's Curve." King Hubbert was a geophysicist who, in 1949, predicted the trajectory of oil extraction in the United States. He figured that the rate of extraction would increase in response to demand, itself fueled

(sorry) by the increasing success in finding oil. This increase would follow a logistic curve, with almost exponential increase at first, followed by a period of increase at slower and slower rates as the easily extractable reserves are tapped out and more expensive technology has to be applied. At some point, extraction would peak and then extraction would drop in a nearly mirror image pattern as the costs of extracting the scarcer and scarcer resource begin to increase exponentially and its success begins to decrease exponentially. The result, plotted through time, looks kind of like the familiar bell curve from the statistical normal probability distribution. In 1949, using this logistic curve, Hubbert predicted that U.S. oil fields would peak around 1960 or so, accurately, it turned out.

Using the same methodology, a number of people have been working on the global Hubbert's Peak. I've heard estimates ranging from 2005 to 2020, so your guesstimate is right smack in the middle of the range.

A very nicely written summary of the situation is given by David Goodstein of Caltech in a popular book entitled, "Out of Gas: The End of the Age of Oil."

Here's a link to the Amazon listing:

http://www.amazon.com/exec/obidos/tg/de ... ce&s=books

Wikipedia has a nice summary, including a few critics of the Hubbert's model:

http://en.wikipedia.org/wiki/Hubbert_peak